Beyond the questions above you should.

Senior living reit etf.

It has a low expense ratio of 0 12 so investors don t have to worry about the expense chipping away at.

A reit etf is a type of fund made up exclusively of reit stocks.

The 10 best reits to buy for 2020 real estate offers diversification and far more income than the market average.

Like all reits these firms are not subject to federal income tax so long as they distribute 90 of their taxable income to shareholders.

Senior housing trust snh next on the list of reits to buy.

Risks of investing in senior living reits.

A health care real estate investment trust known as reit could be a smart move if you want to capitalize on aging trends by including senior housing medical and nursing facilities in their.

Senior living reits are largely in the healthcare reit sector.

The percentage of healthcare and specifically senior living reits will vary from reit to reit.

As of march 30 2020 the fund has over 5 of its holdings invested in health care reits.

In other words senior housing property trust has a.

The ishares cohen steers reit etf icf is another of ishares etfs that has exposure to the reit sector.

Healthcare reits own and operate properties including hospitals senior housing facilities skilled nursing facilities and other medical office buildings.

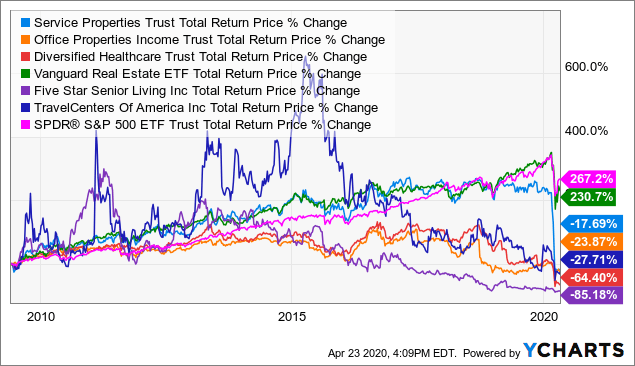

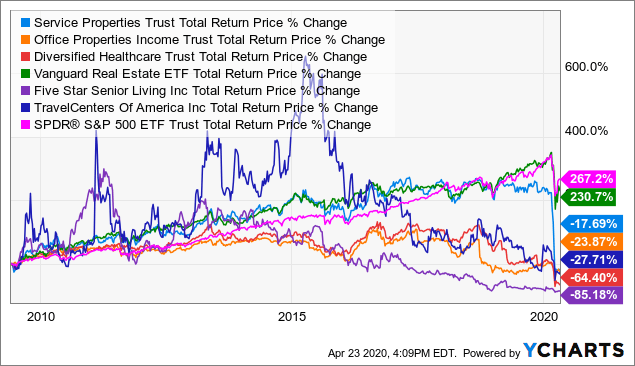

Senior housing property trust s credit ratings of bbb baa3 while still investment grade are lower than those of the other reits discussed.

This vanguard reit etf is a great income producing investment with a yield of 4 1.

Senior housing properties trust snh one of the biggest players in the senior housing segment with 372 properties spread across 38.